Cigar News

More sales, more taxes?

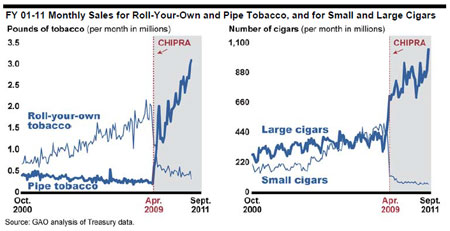

Normally we’d be happy to report news of increased cigar sales, but in this case it’s not really a good thing, IMO. The Government Accountability Office recently released data which demonstrates that cigarette smokers are switching to pipe tobacco and cigars in order to dodge the sales tax on cigarettes, which is substantially higher. The federal government estimates that it has lost between $615 million and $1.1 billion in uncollected sales tax revenue from April 2009 to September 2011. In January of 2009, pipe tobacco sales were just 240,000 pounds. In September 2011, that number rose to 3 million pounds—a tremendous leap. Cigar sales more than doubled in the same timeframe, rising from 411 million pounds to 1 billion pounds.

We’re already starting to see the consequences, and they’re not good. Congress has raised taxes on small cigars to the same rate as cigarettes. As a result, the manufacturers of small cigars have already had to raise the weight of their cigars in order to enter the lower large cigar tax bracket. Naturally the Government Accountability Office has already taken notice of this fact, which means it’s only a matter of time before they end up cracking down on those, too.

Many cigar smokers (if not all) don’t even smoke cigarettes, and it is unfair that cigar aficionados should have to pay a higher tax on their cigars simply because cigarette smokers are dodging taxes, but that could well be what’s in store for the future. That could harm premium cigar manufacturers and tobacconists too, which won’t do any good for small business in this country.